US Jobless Claims Fall to 3-Year Low, What’s the Impact?

Jakarta, Pintu News – Weekly jobless claims in the United States have hit their lowest point in more than three years, an indicator that may ease concerns about a weakening labor market.

This drop comes ahead of the Federal Open Market Committee (FOMC) meeting, where it is expected that the Federal Reserve will cut interest rates, a potentially favorable situation for Bitcoin (BTC) and the crypto market at large.

Introduction: Unemployment Claims Latest Data

Data from the Labor Department showed that initial jobless claims came in at 191,000 for the week ended November 29, down 27,000 from the previous week’s revised level. This is the lowest figure since September 24, 2022, when claims were at 189,000.

This report comes a day after the ADP report showed that private payrolls fell by 32,000 in November, the biggest drop since March 2023. The report further strengthened the argument for a rate cut at next week’s FOMC meeting.

Also Read: 5 Shocking Facts About Strategy: 650,000 BTC worth ±$60 Billion!

Current Labor Market Context

According to a report from Reuters, the labor market is currently considered to be in a “no fire, no hire” state. However, Mohamed El-Erian, a market economist, noted that labor market data tends to be volatile during holiday weeks, such as last week’s Thanksgiving.

This is likely just ‘seasonal noise’ disguising a cooling labor market. This is important as Fed officials will consider this data in next week’s FOMC meeting, deciding whether to prioritize a weakening labor market or rising inflation.

Rate Cut Opportunities and Inflation Data

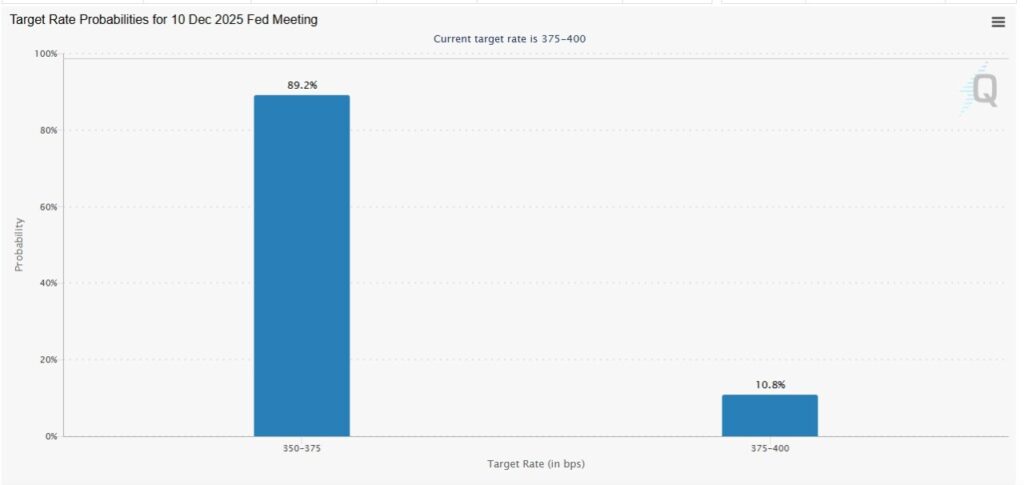

The odds for a rate cut at next week’s Fed meeting remained steady despite the release of weekly initial jobless claims. CME FedWatch data shows that there is currently an 89.2% chance that the Fed will cut rates by 25 basis points (bps).

With initial jobless claims already released, attention now turns to the PCE inflation data due tomorrow. PCE is the Fed’s favorite measure of inflation and will provide insight into whether inflation is rising sharply, as some Fed officials have warned.

Impact on Crypto Market

A lower than expected inflation reading will provide the final push ahead of next week’s FOMC meeting. Significantly, Bitcoin (BTC) and the broader crypto market have recovered in anticipation of a third rate cut this year.

Also Read: Decisive Week: XRP Braces for a Huge December 2025 Surge!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What were the US initial jobless claims for the week ended November 29?

A1: US initial jobless claims for the week ending November 29 were 191,000.

Q2: When was the last time US jobless claims reached such a low level?

A2: The last time US jobless claims hit this low was on September 24, 2022, with 189,000 claims.

Q3: What are the chances that the Fed will cut rates at next week’s FOMC meeting?

A3: Based on CME FedWatch data, there is currently an 89.2% chance that the Fed will cut rates by 25 basis points at next week’s meeting.

Q4: What is the potential impact of interest rate cuts on crypto markets?

A4: An interest rate cut by the Fed is potentially favorable for crypto markets, including Bitcoin (BTC), as it would typically lower the value of the US dollar and boost riskier assets like crypto.

Q5: What is PCE inflation data and why is it important?

A5: PCE (Personal Consumption Expenditures) inflation data is a measure of inflation used by the Federal Reserve to assess price pressures in the economy. This data is important as it helps the Fed in making monetary policy decisions.

Reference

- Coingape. U.S. Weekly Jobless Claims Fall to 3-Year Low Ahead of FOMC Meeting. Accessed on December 5, 2025