Top 5 DeFi Aggregators 2025

Jakarta, Pintu News – In the world of decentralized finance (DeFi), DEX aggregators play an important role in combining liquidity from various platforms to provide the best price for users.

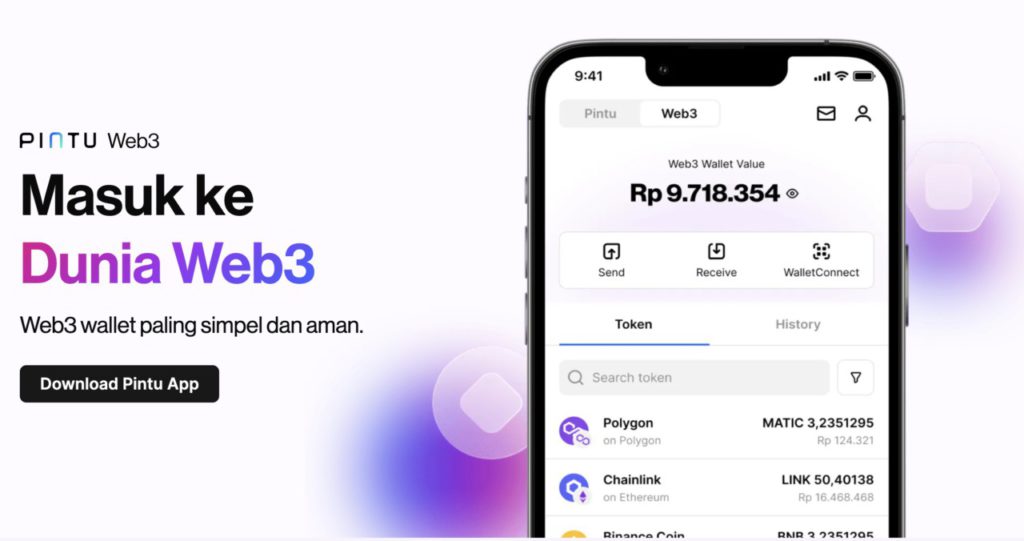

In 2025, the competition between aggregators has intensified, with each offering unique features and advanced technology. Now, with features like the Web3 Wallet Door, users can also stake crypto assets directly by connecting their wallets to various dApps through the in-app browser, expanding integration opportunities and efficiency in the crypto ecosystem.

This article summarizes the five best DeFi aggregators this year, in terms of features, ease of integration, and practical benefits for traders and developers.

1. 1inch

1inch excels thanks to the Pathfinder algorithm, which breaks down transactions into multiple paths to find the best price with minimal gas fees. The platform supports many large networks such as Ethereum, BSC, Polygon, Arbitrum, and others. Features such as limit orders, yield farming, and Chi tokens for gas optimization make it very attractive for large volume traders.

With a professional interface and advanced APIs, 1inch is perfect for institutional traders and developers who need flexible integration solutions. These advantages make it one of the most popular aggregators in the DeFi ecosystem today.

2. Paraswap

Paraswap offers an advanced routing engine with multi-path capabilities, allowing transactions to be processed through different paths for maximum efficiency. The platform is designed for easy integration, complete with modular APIs that can be customized by developers and enterprises.

Also read: Top 5 Altcoins that Surged Silently This Month

Paraswap supports major networks such as Ethereum, BSC, and Polygon. With its open and flexible architecture, this aggregator is a top choice for crypto projects that want to provide a seamless trading experience without building a system from scratch.

3. Matcha

Matcha uses a Request for Quote (RFQ) system to connect users directly to professional market makers, providing high liquidity at competitive prices. The platform is known for its user-friendly interface design while still offering advanced trading features.

Matcha supports a wide range of networks and provides deep analytics data that is useful for institutions as well as experienced users. This makes it an ideal option for anyone looking for a blend of ease of use and execution power.

4. CowSwap

CowSwap offers a unique approach through its Coincidence of Wants (CoW) protocol, which matches orders in batches to prevent front-running and protect users from market manipulation. The system also allows gasless trading, which is ideal for retail users and low-cost traders.

The platform operates on Ethereum and Gnosis, and places great emphasis on security and efficiency in execution. The MEV protection feature makes CowSwap attractive to users who care more about fairness in crypto transactions.

Read also: Pi2Day 2025: The Great Transformation of the Pi Network and the Importance of June 28, 2025!

5. KyberSwap

KyberSwap features a Dynamic Market Maker (DMM) protocol that automatically adjusts liquidity depth based on market volatility. This feature provides higher capital efficiency, supported by elastic pools and professional interfaces.

The platform supports multiple networks and offers advanced analytical tools for active traders. With a robust liquidity management system, KyberSwap is suitable for experienced users who want to optimize the results of their DeFi activities.

Manage staking more flexibly through the Web3 Wallet door!

The five DeFi aggregators above – 1inch, Paraswap, Matcha, CowSwap, and KyberSwap – are pioneers in providing a smarter, faster, and more cost-effective crypto swap experience. Whether for individual users, professional traders, or developers, choosing the right platform can determine the success of a strategy in the cryptocurrency world.

By utilizing the Web3 Wallet Door, it allows users to stake crypto assets directly into various dApps through the in-app browser without the need to switch platforms. This feature provides access to staking protocols from a single, integrated app.

Users can choose staking services according to their preferences and support popular assets such as Ethereum (ETH), Solana (SOL), and other proof-of-stake tokens. The Web3 Wallet door is a practical option to access staking opportunities in the Web3 ecosystem.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Ideasoft. 6 Best DEX Aggregators in 2025: Features, Benefits, and Integration Paths Accessed June 28, 2025.

- Featured Image: Vocal Media