How Much Impact Will the Fed’s Interest Rate Policy Have on the Crypto Market?

Jakarta, Pintu News – As of 2025, the Federal Reserve’s (Fed) policies have had a significant impact on crypto market momentum, and are expected to continue through 2026. With differing opinions among policymakers, the market faces high uncertainty regarding the future direction of interest rates.

The Impact of Fed Policy on Crypto Market

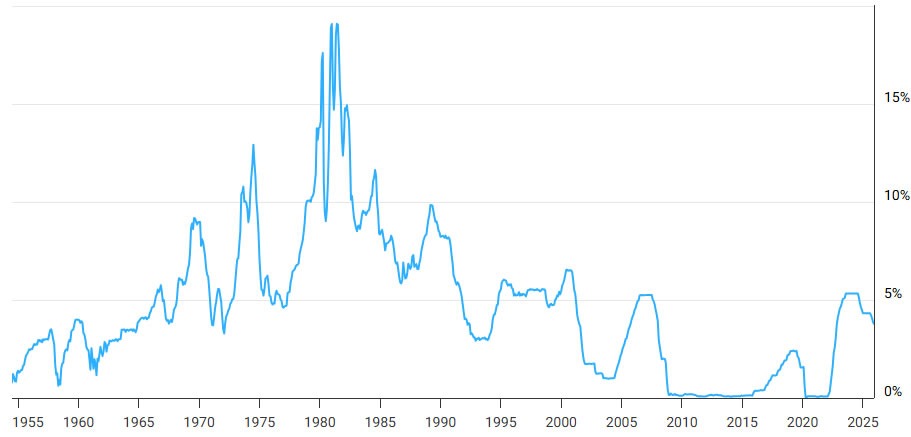

The Fed has made three rate cuts in 2025, with the last cut on December 10 lowering rates to between 3.5% and 3.75%. Although projections suggest there will only be one more cut in 2026, interest rates remain at their highest level since 2008.

Key factors influencing policymakers’ decisions include labor market data, inflation trajectory, especially the impact of tariffs, and overall economic growth.

In May, the Fed will get a new chairman to replace Jerome Powell, and President Donald Trump has shortened the list of dovish-leaning candidates. This could change the Fed’s overall stance on interest rate policy and its willingness to support risky assets like crypto.

Also read: Bitcoin (BTC) Breaks 4-Year Cycle for the First Time in 14 Years!

The Fed’s 2026 Meeting and Its Impact

The upcoming Fed meeting on January 27 and 28 will be crucial as it is the first opportunity for Fed governors to update guidance, which could set the tone for the quarter. According to CME Group, investors predict there is only a 20% probability of a 25 basis point rate cut in January, which increases to 45% at the mid-March Fed meeting.

The current projections for the end of 2025 are 3.6%, which is essentially the current rate, and 3.4% by the end of 2026, which suggests only one cut for 2026. Analysts at Charles Schwab stated after the Fed’s December cut that “the updated projections are not particularly hawkish,” with 12 of 19 policymakers projecting at least one more cut next year.

Also read: Ripple’s Long-Term Predictions: XRP Projected to Break $24 by Analysts

Divisions in Dot Plot and Market Expectations

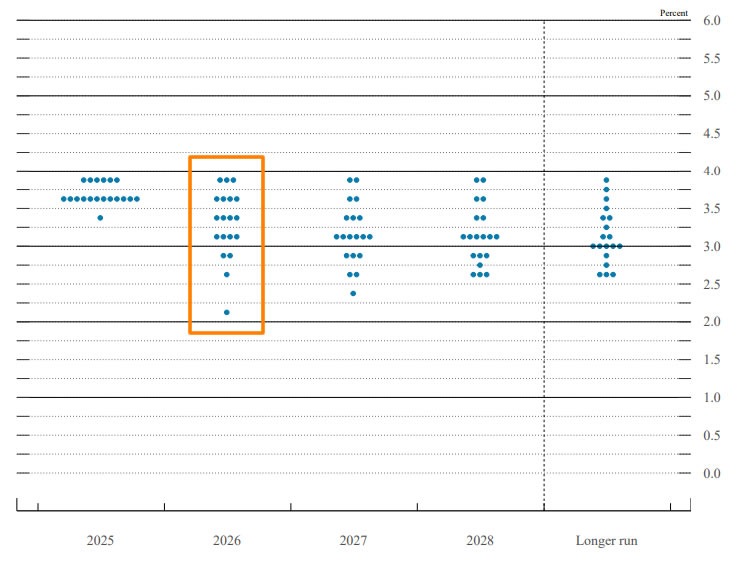

The December 2025 dot plot, which shows each policymaker’s interest rate projection, shows significant dissent, with equal numbers projecting zero, one, or two rate cuts, creating significant uncertainty for the market as 2026 begins.

These charts provide transparency into the Fed’s thinking, yet projections often change as new economic data emerges. Jeff Ko, chief analyst at CoinEx Research, told Cointelegraph that the Fed is “facing significant internal divisions,” and the dot plot shows “a wide spread of views and no clear consensus on the path of rates for 2026.”

Conclusion

With the change in leadership and significant dissent among Fed policymakers, the crypto market may face greater fluctuations. Investors and analysts should pay close attention to any signals from the Fed, as a lower interest rate policy could boost interest in riskier assets such as Bitcoin (BTC) and Ethereum (ETH), which in turn could affect overall market dynamics.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Fed Divided: 2026 Outlook Means Bitcoin and Crypto. Accessed on January 2, 2026

- Featured Image: Generated by AI