Brazil Sees a Crypto Investment Boom, Up 43% This Year

Jakarta, Pintu News – Crypto activity in Brazil is on the rise in 2025, with total transaction volume rising by 43% compared to the previous year. According to the latest report from crypto platform Mercado Bitcoin, the average investment per user this year has surpassed the $1,000 mark.

The report, titled “Raio-X do Investidor em Ativos Digitais 2025“, states that the crypto market in Brazil is no longer driven solely by speculation, but is increasingly influenced by structured investments and careful portfolio planning.

The data in this report is based on activity on the Mercado Bitcoin platform, the largest crypto exchange in Latin America. The report revealed that the average amount of crypto investment per person amounted to around 5,700 Brazilian reals, equivalent to over $1,000.

Brazil Records Increase in Crypto Trading Activity

According to the report, 18% of investors in Brazil placed their funds in more than one type of digital asset, signaling that users are now inclined to diversify their portfolios rather than betting on just one cryptocurrency.

Read also: AI Tokens Dominate Crypto Market, But Data Shows a Different Story

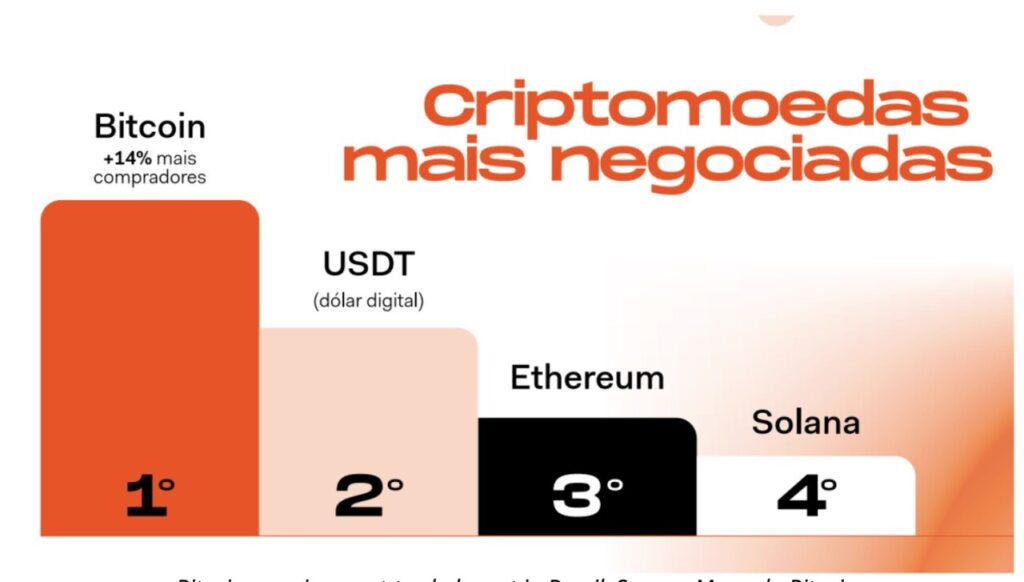

Bitcoin (BTC) remained the most traded digital asset, followed by the USDT stablecoin pegged to the United States dollar. Ethereum (ETH) and Solana (SOL) also saw significant usage throughout the year, according to the report. Stablecoins were cited as a key gateway for new and existing investors to enter the crypto market.

The report also highlighted that fiat-backed assets saw transactions increase by more than three times compared to the previous year. This happened as users sought assets with lower volatility amid uncertain economic conditions.

Low-risk crypto products also showed an increase in 2025. Digital fixed income instruments, known locally as Renda Fixa Digital (RFD), recorded a 108% surge in investment, with Mercado Bitcoin disbursing around $325 million to investors since the start of the year.

In terms of demographics, users aged 24 and under recorded a 56% increase in crypto usage compared to the previous year. However, demand increased across all age groups, including high-net-worth individuals as well as institutional investors.

Geographically, Brazil’s Southeast and South regions continue to dominate transaction volumes, led by São Paulo and Rio de Janeiro. Meanwhile, states in the Central-West and Northeast are also starting to stand out as crypto adoption increases across the country.

B3 Plans to Launch Crypto Products in 2026

The increase in crypto activity in Brazil is also reflected in the move by the Brazilian stock exchange, B3, which will strengthen its involvement in the world of digital assets by launching a tokenization platform and stablecoins for transaction settlement.

Read also: 3 US Stocks That Could Soar Before the End of 2025: AMZN, APPL, COST

The plan is scheduled to begin operations in 2026. A B3 representative said,

“The main value of having a tokenization platform connected to a traditional ecosystem is that assets become interchangeable. Token buyers will not know that they are buying from a traditional stock seller. This allows for a seamless transition with equal liquidity for both.”

In addition, B3 also plans to launch weekly options for Bitcoin, Ethereum, and Solana, as well as prediction contracts similar to those available on speculation platforms. This announcement comes about a month after Brazil’s central bank said it would classify stablecoin transactions as foreign exchange operations for crypto companies.

However, it is unclear how the new policy, which will come into effect in February, will be applied to stock exchanges such as B3.

Meanwhile, Itaú Asset Management advises investors to allocate 1% to 3% of their portfolio to Bitcoin, citing geopolitical risk factors, monetary policy changes, and currency volatility.

Analyst Renato Eid also described Bitcoin as a unique asset with its own return profile and potential as a hedge, thanks to its global and decentralized nature, although the price of Bitcoin has fluctuated sharply since the beginning of 2025.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Crypto activity in Brazil rises 43% with average investment surpassing $1,000: Report. Accessed on December 22, 2025

- Cryptopolitan. Brazil registers 43% rise in crypto activity. Accessed on December 22, 2025