Bitcoin (BTC) nears record highs, investors withdraw funds from Binance!

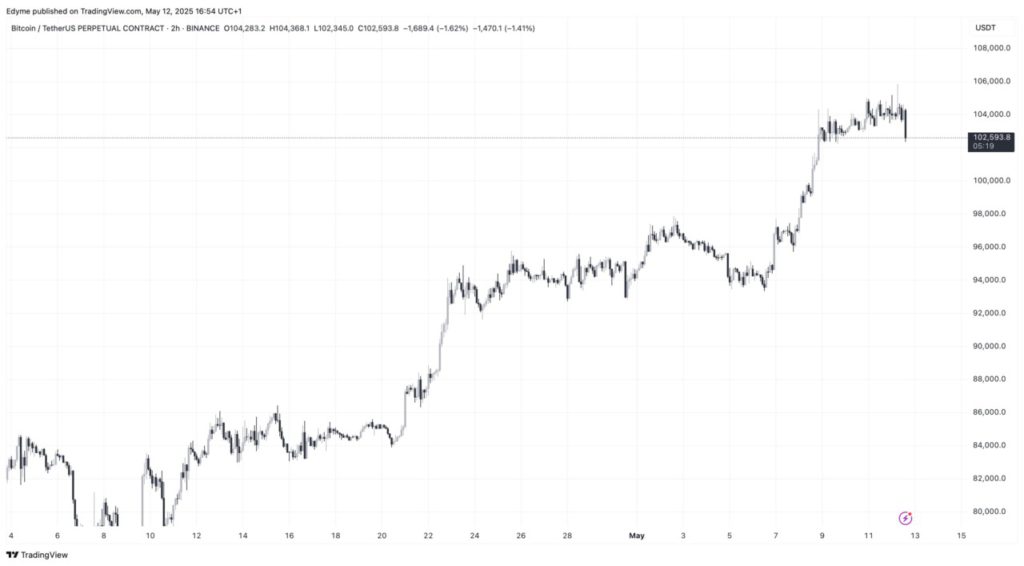

Jakarta, Pintu News – Bitcoin (BTC) has shown another positive trend with a weekly price increase of 10.4%, and is now trading at $103,881. In the past month, the asset has surged more than 24%, driven by growing optimism in both crypto and traditional markets.

Although still 4% below January’s record high, recent indications suggest that bullish momentum may be rebuilding. This renewed price strength appears to be supported by significant capital movements, including a large Bitcoin (BTC) outflow from the Binance exchange.

Bitcoin (BTC) Outflow from Binance

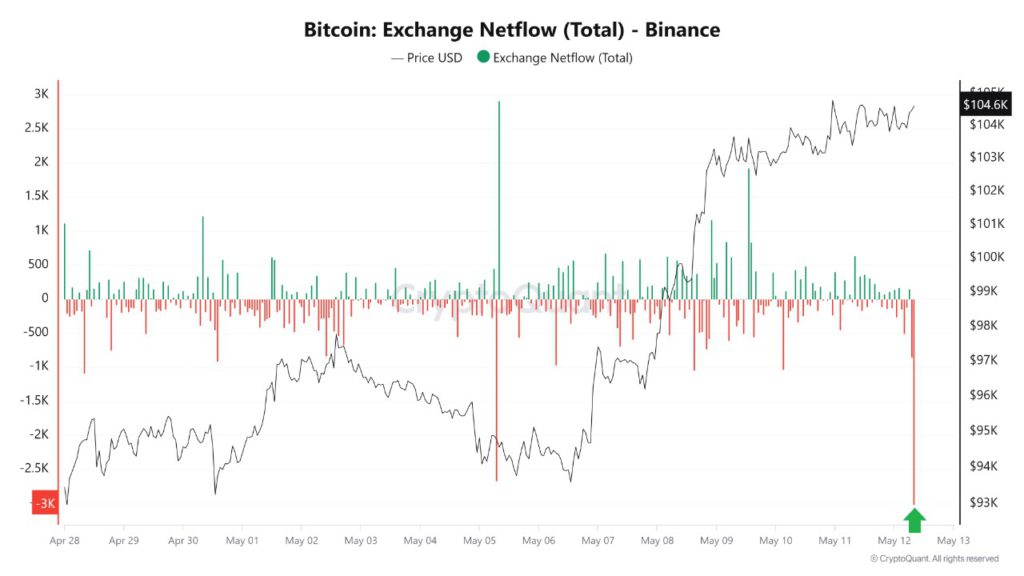

Recent data from CryptoQuant’s QuickTake platform shared by analyst Amr Taha shows that more than 3,000 Bitcoin (BTC), worth approximately $312 million, was withdrawn from Binance on May 12. This represents one of the largest daily outflows in recent months.

This withdrawal coincided with an important macroeconomic development: a new trade deal between the United States and China, which also triggered a sharp rebound in US equity markets, with the S&P 500 surging more than 3%.

Also Read: Potential for XRP, Kaspa, and Solana in the Next Altcoin Cycle According to Analysts!

BTC Balance Drop on Exchanges and Its Impact

Taha’s analysis shows that this substantial Bitcoin (BTC) withdrawal is part of a broader trend. Binance’s BTC reserves have been declining consistently, from around 595,000 Bitcoin (BTC) at the end of February to 541,400 Bitcoin (BTC) in mid-May.

A decrease in balances on exchanges usually signals investors’ preference for cold storage solutions or personal wallets. Historically, such a move is considered an indication of accumulation behavior, indicating lower short-term selling pressure and a more bullish medium-term outlook.

Market Behavior and Macroeconomic Trends

Furthermore, the analyst notes that market participants appear to be increasingly responsive to macro signals. The scale of the Bitcoin (BTC) withdrawal on May 12, paired with a rising equity market, illustrates how capital is shifting between asset classes in response to broader economic developments.

Taha suggested that these coordinated moves reflect renewed risk appetite and a possible readjustment of investor strategies in light of improved global trade dynamics.

Cover: The Future of Bitcoin (BTC)

While it remains to be seen whether this momentum can be sustained, recent patterns support the view that long-term holders and institutional participants are increasingly confident in Bitcoin’s (BTC) role in diversified investment strategies.

As traditional markets recover and geopolitical risks ease, the decline in Bitcoin (BTC) reserves on exchanges and the increase in off-exchange holdings may be the basis for another test of previous record highs. The coming weeks will be crucial in determining whether the current inflows turn into a full-scale breakout or a period of consolidation.

Also Read: New York Mayor Appoints Crypto Advisor After Corruption Case Dropped

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Nears All-Time High as 31.2M BTC Exit Binance Following US-China Trade Deal. Accessed on May 13, 2025

- Featured Image: Generated by AI