Astonishing Prediction: Bitcoin Can Break $131,000, Check out the Conditions!

Jakarta, Pintu News – Bitcoin (BTC) has performed impressively in the past two weeks, fueling speculation about a possible return to the $100,000 price. Recent data suggests that Bitcoin (BTC) could surpass that level and reach new record highs in the coming weeks.

Bitcoin Price Analysis and Projections

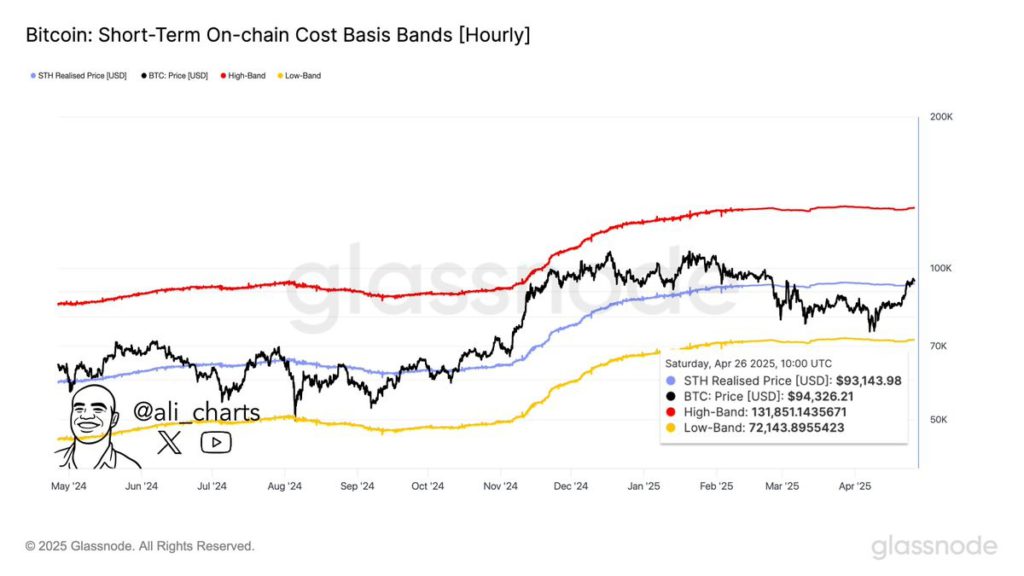

On April 26, renowned crypto analyst, Ali Martinez, shared an interesting analysis and projection for Bitcoin (BTC) price on the X platform. According to him, Bitcoin (BTC) has the potential to reach up to $131,800 provided it can stay above critical support levels.

This analysis is based on the Short-Term Holder Cost Basis (STH Cost Basis), which measures the average price at which new investors, typically wallets holding Bitcoin (BTC) for less than 155 days, acquire their coins.

This metric often provides insight into short-term investor sentiment and can act as a relevant psychological support or resistance level. When Bitcoin (BTC) price is above the STH Cost Basis, this usually signals bullish momentum among short-term market participants.

However, if the price continues to fall below this metric, increased selling pressure could be triggered, as short-term holders are known to be speculative and reactive. According to data from Glassnode, the STH Cost Basis is currently around $93,145, which is a crucial support level for Bitcoin (BTC) prices.

Also Read: Dogecoin’s New Breakthrough: Predicted Price Increase to $0.25!

Potential Correction If Bitcoin Slips

Martinez warns that if Bitcoin (BTC) fails to hold support at $93,145, it could open up opportunities for a broader correction. In this scenario, the market leader may experience a deep price drop towards the next major support level around $71,150 – a drop of almost 25% from the current price.

Currently, the price of Bitcoin (BTC) is hovering around $94,410, showing a 0.6% decline in the last 24 hours. According to data from CoinGecko, the major cryptocurrency is up more than 10% in the weekly time frame.

The Role of Bitcoin Whales in Driving the Price

In a separate post on X, Martinez revealed that Bitcoin (BTC) whales have been active in the market, adding to their holdings following the recent price rally. Whales, who are significant market participants due to their large holdings, also often make informed trading and positioning decisions.

Data from Santiment shows that Bitcoin (BTC) whales (holding between 1,000 – 10,000 coins) have bought over 20,000 BTC in the last 48 hours. With this increased buying activity from large investors, Bitcoin (BTC) price may gain the momentum it needs to attempt to reach new record highs.

Conclusion

With in-depth analysis and recent data, Bitcoin’s (BTC) chances of reaching unprecedented prices seem to depend on its ability to maintain critical support. Investors and market watchers will continue to monitor this dynamic closely, while observing the role of whales in the Bitcoin (BTC) ecosystem.

Also Read: Can Dogwifhat (WIF) Reach $1? FOMO is the main trigger!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Price Run to $131,000: Hold Above This Level. Accessed on April 28, 2025

- Featured Image: Generated by AI