7 historical facts show selling BTC in January is often a bad idea in the crypto market

Jakarta, Pintu News – Bitcoin (BTC) is the talk of the town after historical price analysis showed that selling BTC in January could be a less profitable decision according to monthly return records, with historical data showing January often delivers average profits and hurts sellers’ expectations from the start of the year. This data is monitored by cryptocurrency market analysts for its technical implications to early-year trading strategies.

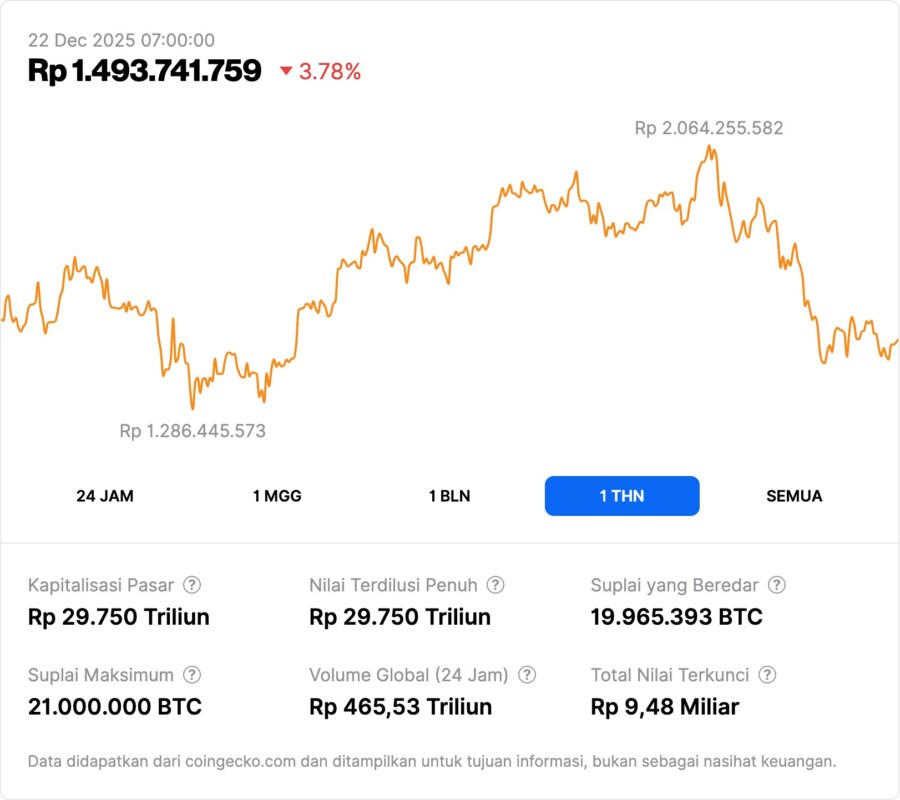

1. Bitcoin Price Approaches $87,700 by the End of 2025

According to the latest price chart, Bitcoin (BTC) fell from its peak in the $120,000-$125,000 zone in October 2025 and was around $87,700 at the end of the year, which is often the reason some traders consider locking in profits (profit taking) before entering January. However, history shows a more complex dynamic.

The average monthly return shows that January recorded an average of +9.76% as well as a median of +9.54% in recent years, indicating a trend of strengthening prices at the beginning of the year.

This analysis is often used as an important metric to evaluate whether year-end selling pressure should be followed by a decision to sell in January or not.

Also Read: 5 Important Facts about the Trending Halving Bittensor (TAO) in the Crypto World

2. Historical Note: January is Often Positive

Bitcoin’s performance history shows that several Januarys produced strong results, including a +39.9% print in 2023 and +29.6% in 2020 after the crypto market came out of the year-end pressure phase. These data sets provide technical evaluation for market participants.

However, not all Januarys end positively: examples of historical declines include -32.1% in 2015, -28.1% in 2018, and -16.9% in 2022, so this pattern is variable and not absolute.

This distinction reflects that although January is often “firm”, volatility is still present, and the decision to sell or buy depends on the broader market context.

3. Year-End Price Position a Risk Factor

Many traders tend to sell at the end of the year to take profits before tax preparation or final bookkeeping, which often results in an additional supply push into January.

When that supply has been exhausted, the price of Bitcoin often bounces back faster due to lighter resistance, a pattern monitored in technical analysis.

This phenomenon shows that the main risk is not selling too early, but often selling too late after the trend strengthens in January, so some sellers re-enter at higher prices.

4. Recommendations from the Historical Record

Historical data shows that focusing on risk positioning at the end of the year is often more important than simply relying on the calendar. For example, if Bitcoin falls below a certain psychological level such as $90,000, risk assessment can change significantly.

In some years, the price position at the end of December provides context for how early January performance may develop. Strong January averages are often driven by positive year-end momentum.

However, cryptocurrency markets remain volatile, so statistical analysis should be accompanied by an assessment of broader macro and technical conditions.

5. Previous Bitcoin Monthly Performance

A look at Bitcoin’s monthly return heat map shows that February also trended positive (around +14.3% on average), while March’s median return trended negative, indicating that the strength of the start of the year tends to be more pronounced in the first two months.

This indicates that certain seasonal patterns in Bitcoin price behavior may provide additional signals for market analysts in predicting the dynamics of the beginning of the year.

Some observers point out that this is related to broad market behavior, global investor sentiment, and changing liquidity dynamics from year to year.

6. Other Historical Context

Another historical evaluation shows that Bitcoin ‘s price performance in January is influenced by the overall market cycle as well as broader macroeconomic events, not merely calendar routines.

Analysis of data from the early period of Bitcoin’s history shows that January’s performance is directly proportional to broader market phases, such as global bull or bear phases, reflecting that macro conditions remain a key driving factor.

Therefore, understanding the broader market context remains important in managing risks and expectations at the start of the year.

7. Potential Risks of Selling in January

Overall, Bitcoin’s price history shows that selling BTC in January often does not yield optimal results based on historical monthly return records, with some periods showing strong gains earlier in the year.

However, this is not a guarantee of consistency as selling pressure, global market volatility and other technical factors can still affect the results in each period.

Therefore, the decision to sell or hold should consider the broader market context and relevant technical and fundamental indicators.

Also Read: Avalanche Price Prediction 2025-2030: Can AVAX Reach $100?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is meant by the warning “selling Bitcoin in January could be bad”?

This refers to historical data showing that January often records positive returns for BTC, so selling at the start of the year could make sellers miss out on potential gains.

Why is January often positive based on history?

January strengthening is often due to early-year market momentum after year-end supply declines and selling pressure eases, creating a tendency for prices to rebound early in the year.

Are sales in January always bad?

No; there were a few Januarys where prices fell, but the historical average and median showed a strengthening trend, so this phenomenon is not absolute.

How does this relate to traders’ decisions?

Traders often utilize historical data as one indicator, but decisions should still be based on broader technical and fundamental analysis.

Reference

- U.Today. Selling Bitcoin (BTC) in January May Be a Bad Idea, Price History Warns. Accessed December 22, 2025