6 Factors that Power Ethereum (ETH) to IDR 75.8 Million and Reach All-Time High!

Jakarta, Pintu News – The price of Ethereum (ETH) surged by 7% on Wednesday, hitting $4,624 or around Rp75,145,488. This increase brings Ethereum closer to the highest price recorded in November 2021, which is only 5.4% away.

This surge further reflects the high interest from institutional and corporate investors who are adding to their Ether (ETH) accumulation. Here are six things you need to know about this latest phenomenon:

1. Ethereum Price Surges to $4,600

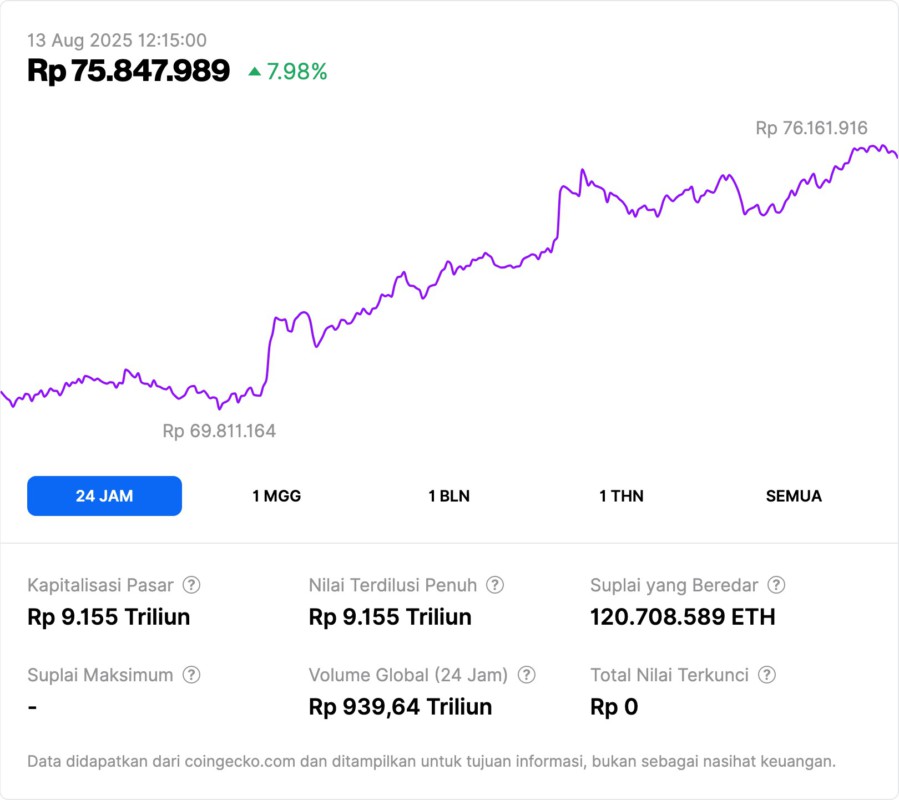

The price of Ethereum (ETH) has experienced a significant surge in the last 24 hours, rising by 7.98% and touching IDR 75,847,989. This increase is close to the record high recorded in November 2021, which reached around IDR 76,161,916.

With strong bullish momentum, the Ethereum price is now on track to surpass that level in the near future, driven by more accumulation from large investors and financial entities.

In recent weeks, accumulation by financial institutions and treasuries has continued to increase, showing how high interest in Ethereum is. Technically, the Ethereum price is predicted to continue this positive trend, given the continued growth of the institutional sector that sees great potential in the Ethereum ecosystem, from DeFi to other blockchain applications.

2. Ether Accumulation by Financial Institutions and Treasuries

According to data collected, Ethereum treasuries focused on managing Ethereum now hold around $16.4 billion in Ether . This shows how much institutional interest there is in the asset.

Most of the accumulation comes from institutions that buy and hold Ether as part of their long-term investment strategies. For example, Bitmine Immersion Tech is the largest holder, holding around 1.2 million ETH, which is worth around $5 . 27 billion.

Their position soared more than 600% in the last 30 days. Meanwhile, SharpLink Gaming controls almost 600,000 ETH, worth $2.74 billion .

3. The Month of July Saw the Sharpest Spike in Ether Holdings by Treasuries

Interest in Ethereum increased sharply in July, with treasury holdings of Ethereum companies increasing by around 127% to more than 2.7 million ETH, which is worth more than $11 . 6 billion.

This surge has been the largest in Ethereum’s history, showing how quickly the traditional financial sector is adapting to blockchain technology and cryptocurrencies.

The existence of this treasury further demonstrates the importance of Ethereum in the world of global finance, from applications in DeFi (Decentralized Finance) to ever-expanding tokenization initiatives.

4. What’s Driving Ethereum Demand?

According to analysts, the demand for Ethereum is mainly fueled by two main factors: use in DeFi and tokenization innovations. With the growing number of Ethereum-based projects, such as decentralized finance (DeFi) applications, asset tokenization, and the development of the NFT platform, Ethereum is increasingly seen as the backbone of the future digital economy.

The ever-growing availability and flexibility of the Ethereum network makes it a top choice for companies and investors interested in the potential of blockchain in various industry sectors.

5. Bitcoin (BTC) Stays Steady, Ethereum Continues to Outperform

Meanwhile, Bitcoin (BTC) has remained stable at around $119,331 (approximately Rp1,936,435,000), despite showing a rise of almost 5% in the past week. While Bitcoin still dominates the overall crypto market, Ethereum (ETH) has performed better in terms of price growth in a short period of time.

The total global crypto market capitalization also recorded a 1.8% increase on the day, with the total market value reaching $4.1 trillion (approximately Rp66.7 quadrillion).

6. What’s the Future Outlook for Ethereum?

With the accumulation trend continuing to increase and with institutional support growing stronger, many market observers are predicting that Ethereum (ETH) will continue to strengthen and may soon break record highs. Large institutions and treasuries that continue to add to their holdings of Ethereum are expected to strengthen long-term demand.

If this trend continues, then Ethereum could be on its way to a new pinnacle position in the cryptocurrency world, changing the existing market dynamics.

Also Read: Moo Deng Price Initial Release, Highest, Year to Date

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Shalini Nagarajan / CryptoNews. Ethereum Surges 7% to Break $4,600, Edges Closer to All-Time High. Accessed August 13, 2025.