3 Reasons PEPE’s 84% Price Rise Has the Potential to Reverse Quickly

Jakarta, Pintu News – Although the price of Pepe Coin (PEPE) has seen a decline of around 3% in the last 24 hours, the rise of almost 84% from the low point in late December and 62% over the last seven days makes it appear to be one of the best performing meme coins this week.

However, a broader view shows that Pepe Coin (PEPE) is still down around 32% over the past three months, signaling that the broader downtrend hasn’t completely disappeared. Although the recent gains seem impressive, there are some indicators that suggest that this rally may not be stable.

Deceptive Bull Flag and EMA Structure

On the 12-hour chart, the price of Pepe Coin (PEPE) appears to be forming a classic pole and bull flag structure. This structure forms when the price rises sharply, then moves sideways or slightly lower to cool down before a potential push higher again. This often attracts momentum traders looking for continuation.

The 50-period exponential moving average (EMA) which reacts faster to price changes, is getting closer to the 100-period EMA. When the short-term EMA moves above the longer one, traders often interpret it as an indication of an ongoing trend change.

Read also: Chainlink’s Long-Term Prediction: LINK Projected to Reach $45 – $75 in 2026

Sales by Big Holders of Pepe Coin (PEPE)

Although the chart shows a positive outlook, the behavior on the blockchain chain tells a different story. Large holders of Pepe Coin (PEPE) have been consistently reducing their exposure since late December.

On December 29, large holders controlled approximately 136.71 trillion Pepe Coin (PEPE). That number has now dropped to around 133.85 trillion Pepe Coin (PEPE), a reduction of almost 2.86 trillion tokens. At current prices, this represents about $20 million of supply distributed to the market.

Also read: Top 4 Crypto that Did a Massive Token Unlock January 2026

Derivatives as an Explanation for Pepe Coin (PEPE) Price Increase

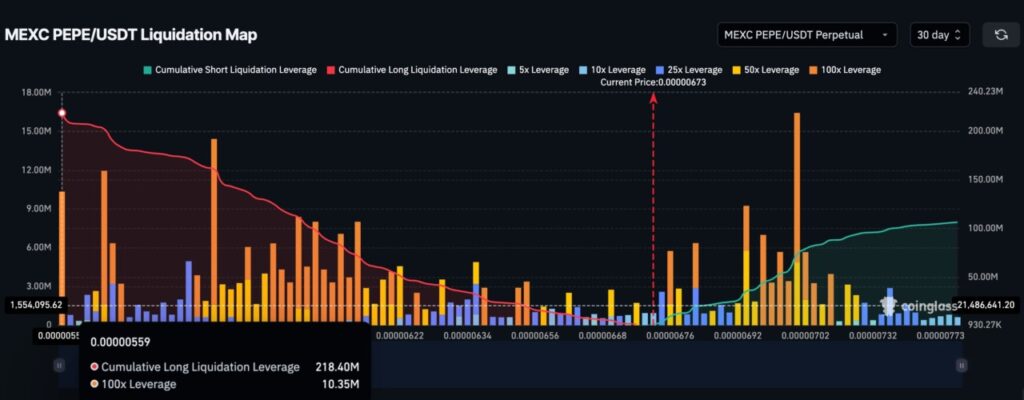

If large holders are selling, why can the Pepe Coin (PEPE) price still rally aggressively? The answer likely lies in the derivatives market. On the 30-day liquidation map for the perpetual Pepe Coin (PEPE) futures, long positions are extremely congested. Cumulative long liquidation leverage is near $218 million, while short liquidation leverage is closer to $106 million.

This suggests that the long exposure is almost double the short exposure. Pepe Coin’s (PEPE) 84% price increase does look impressive, but the underlying signals are mixed. The chart structure appears bullish, but the distribution by large holders, increased coin movement, and dense long positions suggest fragility rather than strength.

Conclusion

While there are several indicators pointing to the continued potential for Pepe Coin (PEPE) price increases, investors and traders should be aware of factors that could cause a rapid price reversal. Understanding market dynamics and the behavior of large holders and derivatives markets is key to navigating this volatile market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Pepe Price Rally Risk. Accessed on January 7, 2026

- Featured Image: Generated by AI