7 CoinGecko Q3 2025 Crypto Reports: ETH and BNB Penetrate ATH, DeFi Rises!

Jakarta, Pintu News – The third quarter of 2025 was a pivotal moment for the global cryptocurrency industry. Based on the latest report from CoinGecko, the crypto market returned to strength for the third consecutive quarter, with various indicators showing a significant recovery.

From the surge in Ethereum (ETH) and BNB (BNB) prices, to the rise of DeFi and increasing trading volumes – the sector is showing signs of entering a new phase worth monitoring.

Here are 7 key points from the CoinGecko Q3 2025 report that show how the crypto industry is getting global attention again.

1. Crypto Market Capitalization Rises 16.4% to $4 Trillion

According to CoinGecko, the global cryptocurrency market capitalization rose by $563.6 billion (+16.4%) during Q3 2025. This brings the total market cap to $4.0 trillion, the highest since late 2021.

This rise was supported by increased liquidity and inflows from institutional investors who started buying up major crypto assets such as Bitcoin (BTC), Ethereum (ETH), and stablecoins.

Also Read: Gold Outperforming Bitcoin? Asset Performance Analysis in 2025

2. Daily Trading Volume Up 43.8% to $155 Billion

Average daily trading volume jumped from $107.8 billion in Q2 to $155.0 billion in Q3, reflecting the surge in market participation that followed the upward price trend.

This is a reversal from the previous two quarters that saw a decline in spot activity, meaning that market participants are starting to become active again, including whales and large institutions.

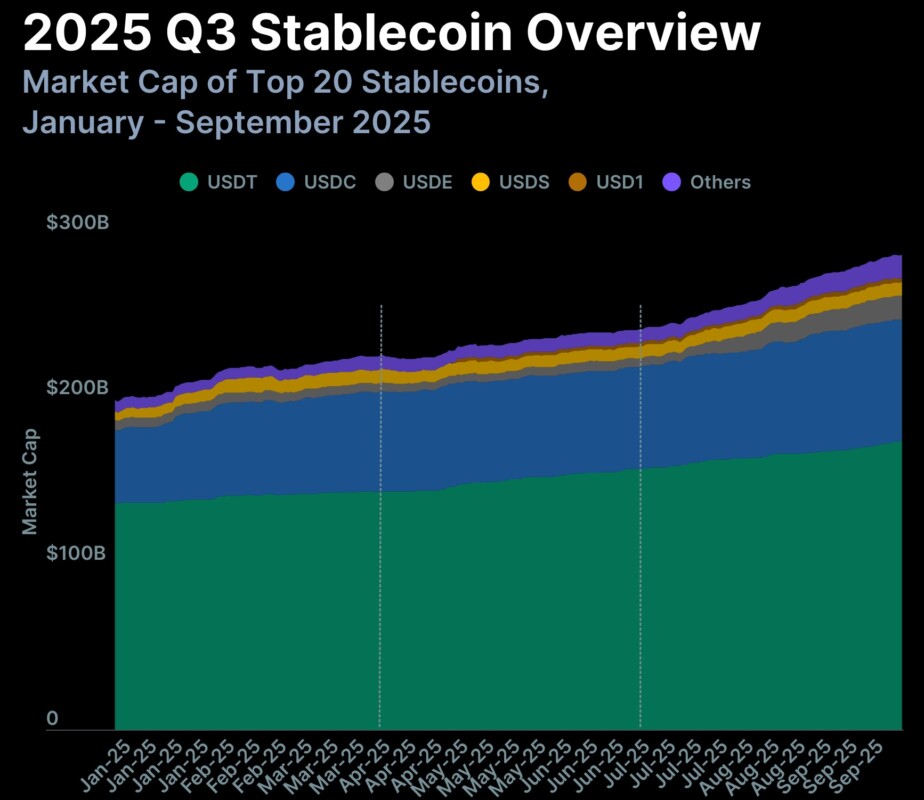

3. Stablecoins Break New Records: $287.6 Billion

The stablecoin market capitalization rose by $44.5 billion (+18.3%), reaching an all-time high of $287.6 billion. USDe and USDC recorded the highest growth.

USDe rose +177.8%, becoming the third-largest stablecoin, while Tether (USDT) continued to dominate despite its market share falling from 65% to 61%. Stablecoins are now an important metric in the crypto market recovery.

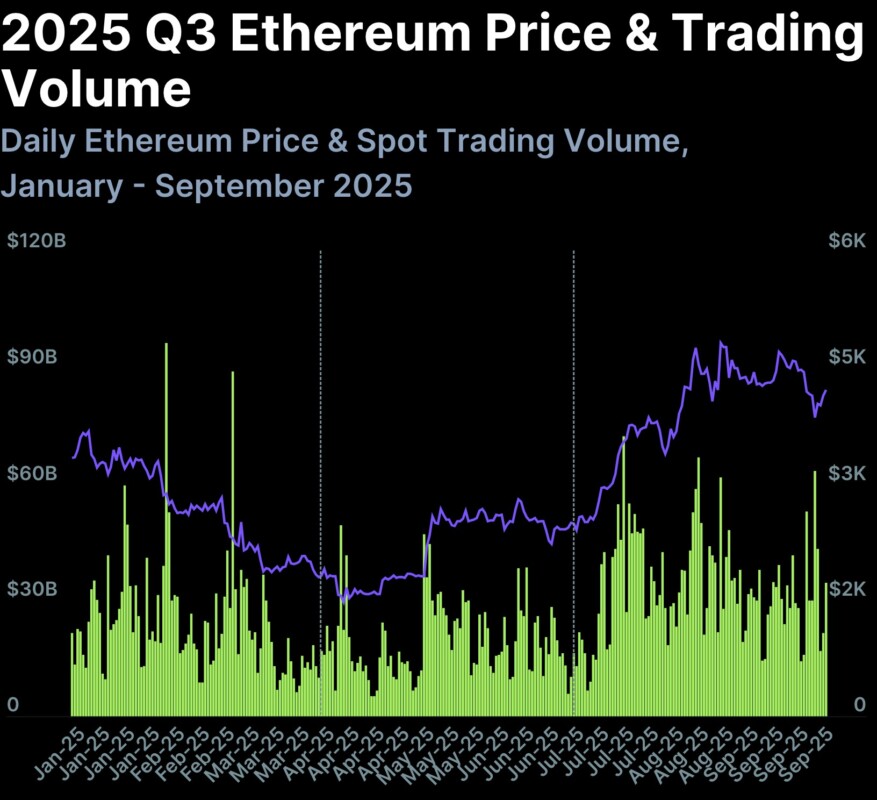

4. Ethereum (ETH) Breaks ATH at $4,946

Ethereum price rose from $2,502 to $4,946, reaching a new All-Time High (ATH) in August 2025 before dropping to $4,215 at the end of the quarter. This increase equates to +68.5% in one quarter.

According to reports, this surge was driven by institutional buying pressure as well as an influx of funds into the Spot ETH ETF, suggesting ETH is increasingly considered a strategic asset.

5. BNB (BNB) Soars 57.3%, Hits $1,048

BNB (token of Binance) saw a huge jump from $654 to $1,048, up +57.3% in the quarter. This is the best performance of the year after stagnating previously.

BNB’s daily volume jumped from $0.8 billion to $1.7 billion, triggered by the launch of perpetual DEXs like Aster that support BNB pairs and the integration of PancakeSwap through the Binance Alpha Program.

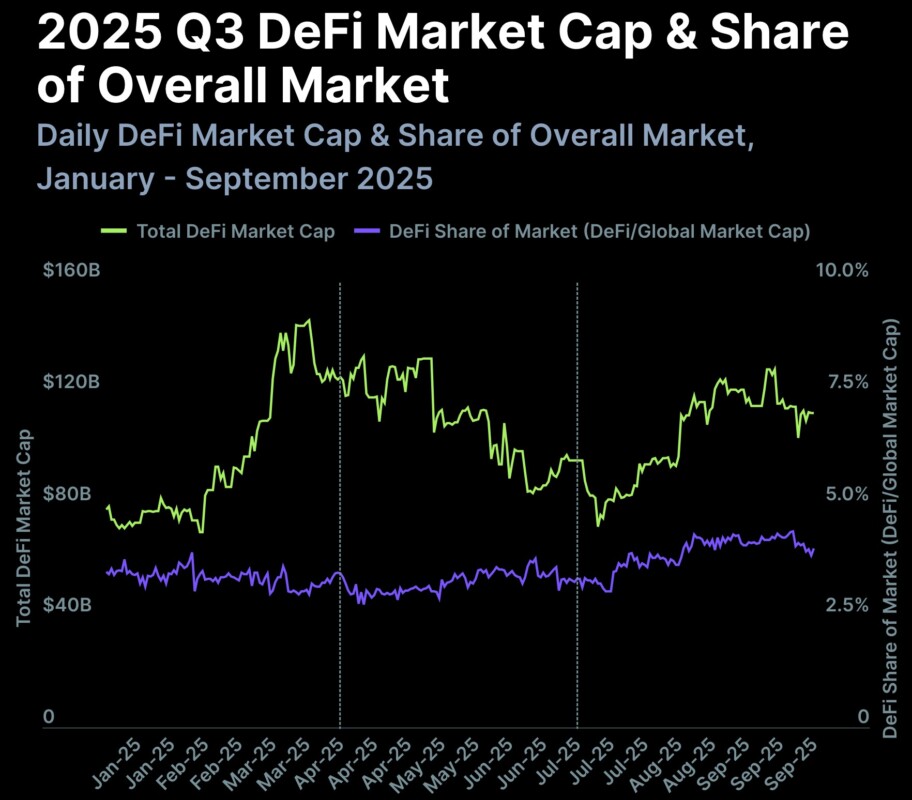

6. DeFi Rises: TVL Up 40.2% to $161 Billion

The decentralized finance (DeFi) sector is showing a major resurgence. Total Value Locked (TVL) rose from $115 billion to $161 billion, driving the sector’s dominance over other categories.

DeFi’s market cap also rose to $181 billion, mainly driven by the launch of new tokens such as Avantis (AVNT) and Aster (ASTER) from perp DEX, putting DeFi back in the spotlight.

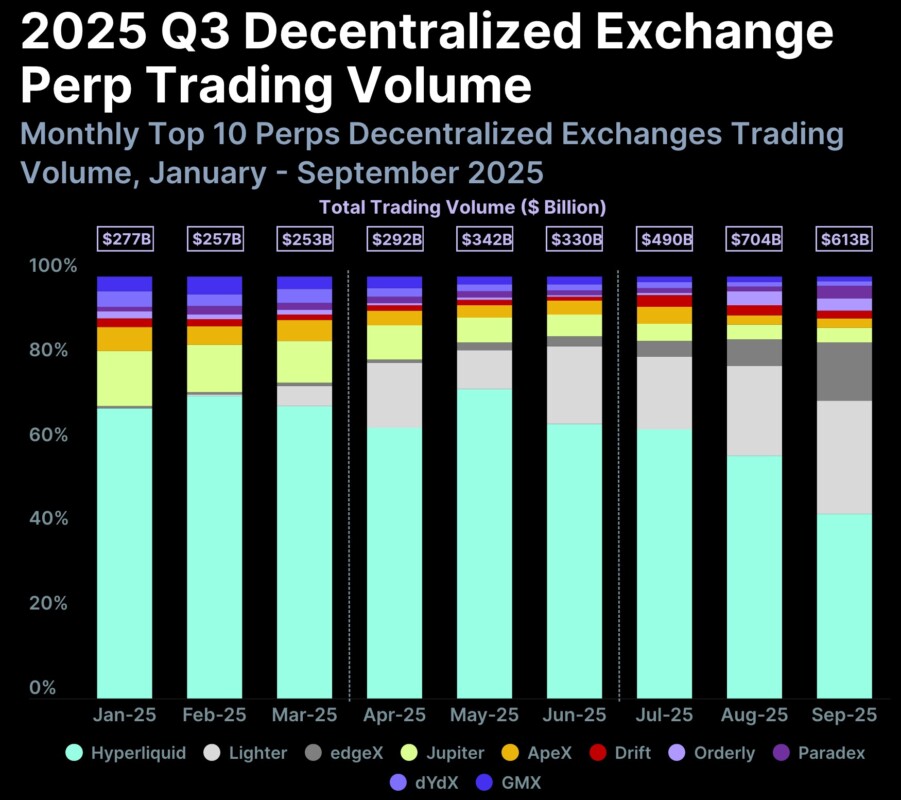

7. DEX Perpetual Reaches New Record: $1.8 Trillion

The trading volume of the perpetual-only DEX (perp DEX) surged +87% to $1.81 trillion, with Hyperliquid maintaining a 54.6% market share.

But now challengers like Aster, Lighter, and edgeX are aggressively offering liquidity incentives. Aster even recorded daily volumes of up to $84.8 billion in September, signaling the emergence of a new formidable altcoin in the decentralized derivatives market.

Also Read: 5 Reasons Solana (SOL) Was Scooped Up by Institutions Despite Falling 30%: Whale’s Stealth Strategy?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ: Questions About CoinGecko’s Q3 2025 Crypto Report

What are the main causes of the crypto market rise in Q3 2025?

According to CoinGecko, the rise was driven by increased liquidity, institutional inflows, and a recovery in trading volumes.

Are stablecoins still relevant in 2025?

Re. Stablecoin capitalization reached $287.6 billion with the highest growth in USDe and USDC, indicating global demand remains strong.

What was the best performing crypto asset in Q3 2025?

Ethereum (ETH) rose +68.5% and BNB (BNB) +57.3%, both recording new record highs in Q3 2025.

How is the DeFi sector currently developing?

DeFi experienced a resurgence with TVL up 40.2% and the launch of a new token from perp DEX, dominating the market compared to other sectors.

Does DEX trading volume beat CEX?

Although spot CEX is still higher, perp DEX volume hit a new record of $1.8 trillion and continues to grow fast.

Reference:

- CoinGecko. 2025 Q3 Crypto Industry Report. Accessed November 19, 2025.