Uniswap Price Prediction: UNI Stays in Key Zone as Open Interest Stabilizes around $150 Million

Jakarta, Pintu News – Uniswap (UNI) is still trading in a narrow consolidation zone, as derivatives data and spot market activity point to cautious sentiment from buyers.

After a recent period of volatility, the token’s momentum is seen weakening, with a number of indicators signaling a neutral position ahead of a possible trend shift ahead.

Uniswap Price Prediction: UNI Open Interest Flat, Reflecting Trader Uncertainty

The latest market data shows that Uniswap’s aggregated open interest stands at around $150.7 million, signaling a balanced position between long and short position holders.

Flat open interest conditions like this often reflect market uncertainty, with traders waiting for more decisive price movements before taking new positions.

The absence of a significant spike in derivatives exposure indicates that market participants are yet to show a clear directional trend – a common feature in the consolidation phase.

If open interest starts to increase alongside rising trading volumes, this could be an early signal of a return of volatility and the potential for stronger directional moves. But for now, Uniswap’s derivatives data supports the view that the market is still in a waiting phase after a prolonged decline.

Market Metrics Show Weak Momentum but Stable Participation

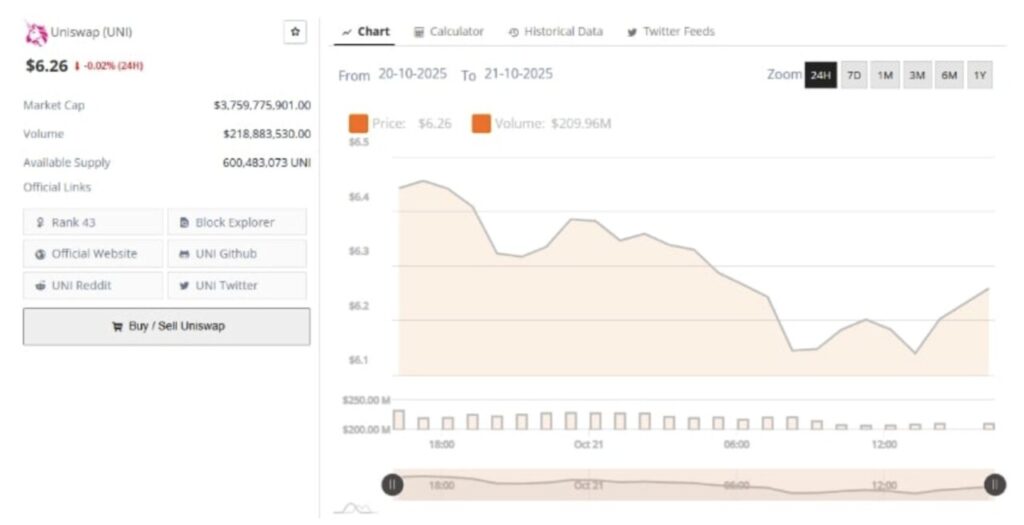

Based on data from BraveNewCoin, Uniswap has a market capitalization of $3.75 billion and ranks 43rd among other cryptocurrencies. Daily trading volume is recorded at around $218.8 million, while the circulating supply stands at 600.48 million tokens.

The latest data showed a slight daily decline of 0.02%, reflecting weakened market interest after several weeks of price correction.

Despite limited price movements, liquidity across major exchanges remained consistent, signaling that the Uniswap ecosystem is still attracting steady activity even in risk-averse market conditions.

This balance between active participation and the absence of strong trends further strengthens the general picture that the market is in a consolidation phase.

Read also: Solana Price Edges Toward Breakout — Could a 20% Surge Mark the Turning Point?

Technical Indicators Highlight Trading in Narrow Ranges

Currently, the UNI/USDT pair is trading in a restricted zone on the daily chart, where neither the bulls nor the bears have shown clear dominance. The Bulls and Bears Power (BBPower) indicator registered a negative reading of -0.727, signaling short-term bearish pressure.

On the other hand, the Chaikin Money Flow (CMF) is still in positive territory at 0.10, indicating mild accumulation-but not yet strong enough to trigger a price breakout.

Price action continues to move in a narrow range between $6.17 to $6.30, with volatility decreasing-a signal of a potential squeeze before the next price move. If CMF remains in the positive zone and open interest starts to increase, a short-term rally towards the $7.00-$7.20 range could occur.

On the contrary, failure to hold the current support could pave the way for a retest of the $5.80 area in the coming sessions.

Overall, Uniswap’s current technical condition shows a market that is in a neutral to cautious phase. Traders seem to be waiting for clearer confirmation-either from increased volume or a breakout of resistance above the price range-before taking further directional positions.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Brave New Coin. Uniswap Price Outlook Holds Key Range as Open Interest Steadies Around $150M. Accessed on October 23, 2025